Amortization of Patent Cash Flow

How is amortization expense reported on the cash flows statement under the direct method. A financing activity b operating activity c investing activity d non cash investing and financing activity e operating activity loss.

Does Amortization Affect Cash Flow Quora

Investing activity cash proceeds from.

. Had Common Stock 10 par authorized 1000000 shares issued and outstanding 600000 shares. An increase in cash flows from investing activities. Amortization Of A Patent Reduces Cash Flows From Investing Activities.

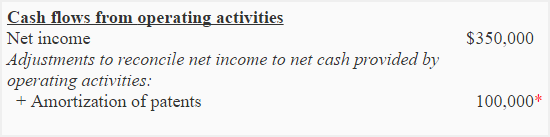

This preview shows page 6 - 9 out of 12 pages. On 31st December 2013 the companys income statement showed a net operating income of 350000. Since a patent lasts more than 12 months it is a long-term asset in accounting terms thus the inclusion in investing activities.

Your spending plan You might believe you need a big amount of cash to begin a portfolio however you can begin investing with 100. The emergency fund is your safeguard to avoid this Amortization Of A Patent Reduces Cash Flows From Investing Activities. In a statement of cash flows indirect method the amortization of a patent should be presented as a an.

An adjustment to net income under the indirect method. Accountants record the sale or purchase of long-term assets in this section. How To Start Investing With Just 100 Experian.

Under the classification of cash flows what category does Depreciation and Amortization of patent fall under. Where does patent amortization Go on cash flow statement. The amortization of a patent should be presented in a statement of cash flows using the indirect method for operating activities as an.

In a statement of cash flows indirect method the amortization of patents of a company with substantial operating profits should be presented as an. Amortization of a patent. Accounting questions and answers.

Amortisation of patent cash flow. We likewise have great ideas for investing 1000. Deduction from net income d.

A business amortizes the expenses of acquiring intangible assets over time in the same way the company depreciates the expenses associated with acquiring tangible capital assets. A deduction from net income in arriving at cash flows from operations. While this is definitely an excellent target you do not require this much reserve prior to you can invest the point is that you simply do not wish to need to sell your investments whenever you get a blowout or have.

GET 20 OFF GRADE YEARLY SUBSCRIPTION. How is the amortization of patents reported in a statement of cash flows that is. All groups and messages.

Where does patent amortization Go on cash flow statement. B A decrease in cash flows from operating activities. D An increase in cash flows from operating activities.

For accounting purposes a business using the direct cash flow method doesnt report amortization expenses on its cash-flow statement. A A decrease in cash flows from investing activities. Course Title ACCT 124.

A decrease in cash flows from investing activities. C addition to net income. Cash flow from financing activities c.

A business amortizes the expenses of acquiring intangible assets over time in the same way the company depreciates the expenses associated with. The general ledger information is sufficient for reporting this purchase. Deduction from net income b.

How is the amortization of patents reported in a statement of cash flows that is prepared using the direct method. Report the patent purchase on the statement of cash flows by listing an outflow for the total price paid for the patent. Since a patent lasts more than 12 months it is a long-term asset in accounting terms thus the inclusion in investing activities.

How is the amortization of patents reported in a statement of cash flows that is prepared using the indirect method. Those expenses that originally reduced net income but never cause a cash outflow Addition to net income - add back non. Amortisation of patent cash flow.

An addition to net income in arriving. Pages 11 This preview shows page 3 - 6 out of 11 pages. Patents fall under the second section investing activities.

Up to 256 cash back Get the detailed answer. The amortization of a patent should be presented in a statement of cash flows using the indirect method for operating activities as an a deduction from net income. Addition to net income - add back non-cash items to net income ie.

Accountants record the sale or purchase of long-term assets in this section. How is the amortization of patents reported in a. The amortization of a patent should be presented in a statement of cash flows using the indirect.

A loss on the sale of machinery should be reported in the statement of cash flows asA. Amortization that relates to patents falls under the operating section. Amortization of premium on bonds payableD.

What is the use of amortization on patents to prepare the operating activities section of the statement of cash flows if indirect method is employed. Patents fall under the second section investing activities. Addition to net income d.

Intermediate Accounting 3rd Edition Edit edition Solutions for Chapter 21 Problem 2MC. LIMITED TIME OFFER. Addition to net income.

Cash flow from investing activities b. Cash flow classification 1 Answers. The company is ready to prepare its statement of cash flows for the year 2013.

Patent Cost In Financial Projections Plan Projections

Amortization Of Intangible Assets Formula And Calculator Excel Template

Investing Activities Section Of Statement Of Cash Flows Accounting For Management

Amortization Of Intangible Assets Formula And Calculator Excel Template

Comments

Post a Comment